It’s all too easy to lose focus on what’s important in the craziness of daily life. Unfortunately, this negligence frequently causes many investors to deliver underwhelming results or, in the worst situations, suffer significant losses.

I’ve compiled a few illustrations from author, investor, and financial educator Brian Feroldi that teach straightforward yet crucial concepts that every investor should constantly keep in mind. I’d want to go through five of his investing philosophy’s most notable teachings today:

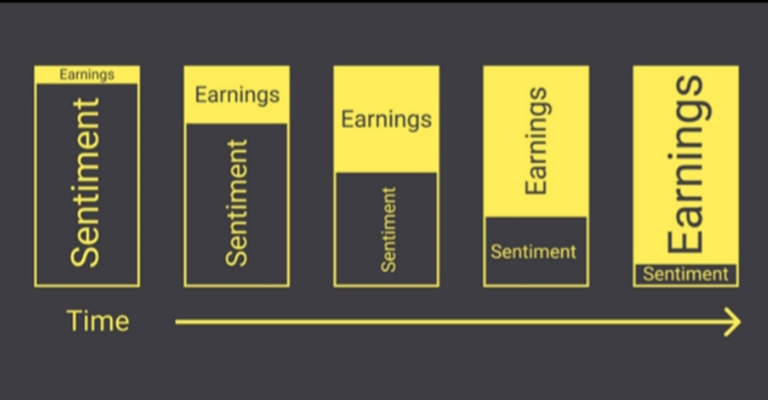

What Truly Drives Markets

Earnings and dividends are the only two real factors that affect how well our markets function, according to John Bogle. Speculative variables like values expressed by measures like the P/E ratio also come into play, primarily in the near term.

Focus on the Controllable

Regrettably, some investors continue to base their whole investment plans and way of life on forecasts about when the Fed could lower interest rates—projections that have changed 10 times over the last nine months. Really?

What is genuinely under your control? Definitely not inflation, interest rates, or the markets themselves. Your capacity for monthly saving, the part allotted to investments, your asset allocation, rebalancing, and accumulation objectives are all things you may manage.

All of these factors are under your control. Turn your attention away from things that are beyond of your control and towards what is actually important.

Also Read | Financial Advice you must give your child

Invest with Favorable Odds

Since the beginning of stock markets, buying a straightforward ETF that tracks the S&P 500 index and holding it for at least 17 years has consistently produced positive returns through pandemics, wars, financial crises, and banks collapses.

Time is your friend, assuming you have enough of it, as can be seen in the image above. You could object, “But 17 years is too long!” (though perhaps not considering modern life expectancy).

However, the very minimum should be an investment horizon of at least 8–10 years. The fact that Warren Buffett, the greatest investor of all time, has held onto stocks for over 20 years (he owned Coca-Cola Co. for 34 years) is not a coincidence.

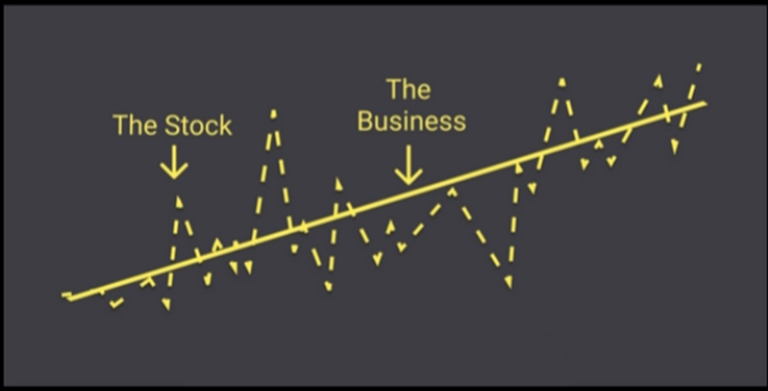

Invest in Businesses, Not Stocks

I hate to keep bringing up Buffett, but he continually gets things right. You don’t purchase a piece of paper in the hopes that its value would increase.

You are purchasing a business that regularly manufactures and sells things or services and is made up of employees, facilities, services, patents, and customers. Additionally, this company creates both present and future cash flows.

Therefore, you’re making an investment in a company that produces cash flows, hopefully at a favourable price. This knowledge enhances your first assessments while choosing certain stocks.

The price of a stock might change a lot, especially in the near term, but if you understand the firm and it keeps expanding, your outcomes will eventually be favourable.

Short-Term Risks ≠ Long-Term Risks (and Vice Versa)

It is safer to purchase government bonds than hazardous stocks. Are you certain in every way?

Maybe it’s time to briefly rethink what danger is.

What risk is not over time: swings between highs and lows. Risks include not meeting your financial objectives and not exceeding inflation.

When seen in this light, equities are the only asset class capable of producing substantial returns over medium to long periods in addition to covering inflation.

We could list a hundred more lessons along these lines, but understanding these first five will put you one step closer to success in an ostensibly straightforward but nonetheless poorly understood environment.

200 comments

great article

Insightful piece

I’m impressed, I have to say. Actually rarely do I encounter a blog that’s both educative and entertaining, and let me let you know, you will have hit the nail on the head. Your idea is excellent; the difficulty is one thing that not sufficient persons are talking intelligently about. I’m very joyful that I stumbled throughout this in my search for something regarding this.

Hello! I could have sworn I’ve been to this blog before but after browsing through some of the post I realized it’s new to me. Anyways, I’m definitely happy I found it and I’ll be book-marking and checking back frequently!

Awsome website! I am loving it!! Will be back later to read some more. I am bookmarking your feeds also.

Puravive is a weight management supplement formulated with a blend of eight exotic nutrients and plant-based ingredients aimed at promoting fat burning.

I keep listening to the newscast lecture about receiving boundless online grant applications so I have been looking around for the most excellent site to get one. Could you tell me please, where could i get some?

great post, very informative. I wonder why the other experts of this sector don’t notice this. You must continue your writing. I’m confident, you’ve a great readers’ base already!

I¦ve recently started a blog, the information you offer on this web site has helped me tremendously. Thank you for all of your time & work.

Valuable info. Lucky me I found your site by accident, and I am shocked why this accident didn’t happened earlier! I bookmarked it.

Hello, you used to write wonderful, but the last few posts have been kinda boring?K I miss your super writings. Past several posts are just a little bit out of track! come on!

With havin so much content do you ever run into any issues of plagorism or copyright infringement? My site has a lot of exclusive content I’ve either authored myself or outsourced but it seems a lot of it is popping it up all over the internet without my agreement. Do you know any techniques to help protect against content from being ripped off? I’d certainly appreciate it.

I like your writing style genuinely enjoying this site.

Dead composed subject material, Really enjoyed looking through.

What Is FitSpresso? FitSpresso is a natural weight loss supplement that alters the biological cycle of the body to burn more calories and attain a slim and healthy body

Undeniably believe that that you said. Your favorite reason appeared to be at the internet the simplest thing to have in mind of. I say to you, I certainly get annoyed even as people think about worries that they plainly do not know about. You controlled to hit the nail upon the highest as well as defined out the entire thing with no need side effect , folks could take a signal. Will probably be back to get more. Thank you

You really make it seem so easy with your presentation but I find this topic to be actually something that I think I would never understand. It seems too complicated and very broad for me. I am looking forward for your next post, I’ll try to get the hang of it!

I am not real wonderful with English but I get hold this very easy to interpret.

It’s actually a great and helpful piece of information. I’m glad that you shared this useful info with us. Please stay us up to date like this. Thank you for sharing.

We are a group of volunteers and opening a new scheme in our community. Your site provided us with valuable information to work on. You have done an impressive job and our entire community will be thankful to you.

What i don’t realize is actually how you’re not actually much more well-liked than you may be right now. You’re so intelligent. You realize therefore considerably relating to this subject, produced me personally consider it from numerous varied angles. Its like men and women aren’t fascinated unless it is one thing to accomplish with Lady gaga! Your own stuffs outstanding. Always maintain it up!

I really appreciate this post. I have been looking all over for this! Thank goodness I found it on Bing. You’ve made my day! Thanks again

Very nice info and right to the point. I am not sure if this is in fact the best place to ask but do you people have any thoughts on where to employ some professional writers? Thanks 🙂

You are my inhalation, I own few web logs and rarely run out from to brand : (.

Thank you for some other magnificent article. Where else may just anyone get that type of information in such an ideal manner of writing? I have a presentation subsequent week, and I am on the search for such info.

Some really nice stuff on this web site, I like it.

Wow! Thank you! I continuously wanted to write on my website something like that. Can I include a fragment of your post to my site?

Hey there this is somewhat of off topic but I was wanting to know if blogs use WYSIWYG editors or if you have to manually code with HTML. I’m starting a blog soon but have no coding expertise so I wanted to get guidance from someone with experience. Any help would be greatly appreciated!

What is Tea Burn? Tea Burn is a new market-leading fat-burning supplement with a natural patent formula that can increase both speed and efficiency of metabolism. Combining it with Tea, water, or coffee can help burn calories quickly.

With everything that seems to be developing within this specific area, many of your points of view tend to be quite radical. Nonetheless, I appologize, because I can not give credence to your entire theory, all be it stimulating none the less. It appears to me that your commentary are not totally rationalized and in actuality you are generally yourself not really wholly confident of your assertion. In any case I did take pleasure in reading it.

I have been exploring for a little for any high-quality articles or weblog posts in this kind of space . Exploring in Yahoo I at last stumbled upon this website. Reading this info So i’m happy to convey that I’ve an incredibly good uncanny feeling I found out exactly what I needed. I such a lot no doubt will make certain to do not forget this web site and give it a glance regularly.

Hello my friend! I want to say that this post is amazing, nice written and include approximately all important infos. I would like to see more posts like this.

I like this post, enjoyed this one regards for putting up.

Very nice layout and great subject matter, absolutely nothing else we need : D.

I like this website so much, saved to bookmarks. “Nostalgia isn’t what it used to be.” by Peter De Vries.

Thanks for sharing excellent informations. Your site is very cool. I am impressed by the details that you have on this web site. It reveals how nicely you understand this subject. Bookmarked this web page, will come back for more articles. You, my pal, ROCK! I found simply the information I already searched everywhere and just could not come across. What a perfect site.

As soon as I discovered this site I went on reddit to share some of the love with them.

I love it when people come together and share opinions, great blog, keep it up.

Hi, just required you to know I he added your site to my Google bookmarks due to your layout. But seriously, I believe your internet site has 1 in the freshest theme I??ve came across. It extremely helps make reading your blog significantly easier.

I was reading some of your posts on this site and I believe this web site is very informative! Keep on posting.

With havin so much content and articles do you ever run into any problems of plagorism or copyright violation? My website has a lot of unique content I’ve either authored myself or outsourced but it looks like a lot of it is popping it up all over the internet without my agreement. Do you know any solutions to help protect against content from being stolen? I’d truly appreciate it.

Glad to be one of several visitants on this awful site : D.

You actually make it appear really easy together with your presentation but I to find this topic to be actually one thing which I believe I would never understand. It kind of feels too complicated and very huge for me. I’m having a look ahead on your next submit, I?¦ll try to get the hang of it!

I am glad to be one of several visitants on this great site (:, regards for posting.

Outstanding post, I think people should acquire a lot from this site its real user pleasant.

I have not checked in here for some time as I thought it was getting boring, but the last several posts are good quality so I guess I will add you back to my everyday bloglist. You deserve it my friend 🙂

My spouse and I stumbled over here coming from a different web page and thought I may as well check things out. I like what I see so now i am following you. Look forward to checking out your web page repeatedly.

It is best to participate in a contest for top-of-the-line blogs on the web. I’ll recommend this site!

My developer is trying to persuade me to move to .net from PHP. I have always disliked the idea because of the expenses. But he’s tryiong none the less. I’ve been using WordPress on various websites for about a year and am worried about switching to another platform. I have heard excellent things about blogengine.net. Is there a way I can import all my wordpress posts into it? Any kind of help would be greatly appreciated!

F*ckin’ amazing things here. I am very happy to see your article. Thanks so much and i’m taking a look forward to contact you. Will you please drop me a mail?

Awsome blog! I am loving it!! Will come back again. I am taking your feeds also

Good day! Do you know if they make any plugins to help with SEO?

I’m trying to get my website to rank for some targeted keywords but I’m not seeing very good results.

If you know of any please share. Kudos! I saw similar article here: Eco wool

As a Newbie, I am constantly exploring online for articles that can help me. Thank you

Hey! Do you know if they make any plugins to assist with Search Engine Optimization? I’m trying to

get my site to rank for some targeted keywords but I’m not seeing very good gains.

If you know of any please share. Thanks! I saw similar text here:

Code of destiny

Can I just say what a relief to find somebody who actually is aware of what theyre talking about on the internet. You positively know how you can carry a difficulty to light and make it important. Extra individuals need to read this and perceive this facet of the story. I cant imagine youre not more popular because you undoubtedly have the gift.

I was studying some of your blog posts on this internet site and I think this internet site is very instructive! Retain posting.

This website is amazing, with a clean design and easy navigation.

The layout is visually appealing and very functional.

It provides an excellent user experience from start to finish.

I’m really impressed by the speed and responsiveness.

I love how user-friendly and intuitive everything feels.

I’m really impressed by the speed and responsiveness.

I’m really impressed by the speed and responsiveness.

It provides an excellent user experience from start to finish.

The content is well-organized and highly informative.

This website is amazing, with a clean design and easy navigation.

I am really inspired with your writing abilities as smartly as with the layout on your blog. Is that this a paid subject or did you customize it yourself? Anyway keep up the nice quality writing, it’s rare to peer a nice blog like this one nowadays. I like onverze.com !

I’m extremely inspired with your writing talents and also with the structure on your weblog. Is this a paid topic or did you modify it your self? Anyway stay up the excellent high quality writing, it is rare to peer a nice weblog like this one nowadays. I like onverze.com ! It is my: Affilionaire.org

I am really impressed along with your writing skills as neatly as with the format on your weblog. Is this a paid subject or did you customize it yourself? Anyway keep up the nice quality writing, it’s rare to look a nice weblog like this one today. I like onverze.com ! Mine is: Beehiiv

Enjoyed reading this, very good stuff, thankyou.

I like your writing style truly enjoying this internet site.

I am extremely impressed with your writing skills as neatly as with the layout in your weblog. Is that this a paid subject or did you modify it your self? Either way stay up the excellent quality writing, it’s rare to peer a nice weblog like this one nowadays..

It’s actually a nice and useful piece of info. I’m glad that you shared this useful info with us. Please keep us informed like this. Thanks for sharing.

продажа аккаунтов маркетплейс аккаунтов соцсетей

магазин аккаунтов продажа аккаунтов

платформа для покупки аккаунтов заработок на аккаунтах

покупка аккаунтов покупка аккаунтов

заработок на аккаунтах площадка для продажи аккаунтов

продажа аккаунтов маркетплейс аккаунтов

маркетплейс аккаунтов маркетплейс аккаунтов

маркетплейс аккаунтов соцсетей маркетплейс аккаунтов

площадка для продажи аккаунтов аккаунт для рекламы

продажа аккаунтов соцсетей площадка для продажи аккаунтов

площадка для продажи аккаунтов купить аккаунт

купить аккаунт биржа аккаунтов

маркетплейс аккаунтов аккаунт для рекламы

купить аккаунт с прокачкой https://kupit-akkaunt-top.ru

купить аккаунт с прокачкой купить аккаунт

Verified Accounts for Sale Buy and Sell Accounts

Gaming account marketplace Gaming account marketplace

Buy accounts Buy Account

Profitable Account Sales Account Selling Platform

Account Selling Service Purchase Ready-Made Accounts

Accounts market Purchase Ready-Made Accounts

Database of Accounts for Sale Online Account Store

Find Accounts for Sale socialmediaaccountsshop.com

Website for Selling Accounts Account Selling Service

Sell Pre-made Account Secure Account Sales

Account Selling Service Website for Buying Accounts

account trading account catalog

secure account purchasing platform account exchange service

account buying platform secure account sales

account trading account exchange service

buy and sell accounts account selling platform

website for selling accounts https://buycheapaccounts.com

secure account purchasing platform account catalog

sell account find accounts for sale

sell pre-made account account trading

marketplace for ready-made accounts sell accounts

account trading account marketplace

buy pre-made account online account store

sell accounts accounts for sale

find accounts for sale database of accounts for sale

sell pre-made account purchase ready-made accounts

sell accounts account purchase

guaranteed accounts buy pre-made account

sell account account market

account purchase secure account sales

account purchase buy and sell accounts

online account store account store

sell accounts account trading

gaming account marketplace sell pre-made account

buy accounts marketplace for ready-made accounts

account market marketplace for ready-made accounts

sell pre-made account verified accounts for sale

account buying platform accounts-buy-now.org

account market buy account

website for buying accounts https://accounts-offer.org

buy and sell accounts accounts-marketplace.xyz

account catalog https://buy-best-accounts.org/

sell account https://social-accounts-marketplaces.live

social media account marketplace accounts marketplace

account sale https://social-accounts-marketplace.xyz

database of accounts for sale https://buy-accounts.space/

Este site é realmente incrível. Sempre que consigo acessar eu encontro coisas incríveis Você também vai querer acessar o nosso site e descobrir mais detalhes! informaçõesexclusivas. Venha descobrir mais agora! 🙂

online account store https://buy-accounts-shop.pro/

account trading platform account marketplace

account trading platform https://buy-accounts.live

sell accounts https://accounts-marketplace.online/

Explore the ranked best online casinos of 2025. Compare bonuses, game selections, and trustworthiness of top platforms for secure and rewarding gameplaycasino.

database of accounts for sale accounts-marketplace-best.pro

купить аккаунт akkaunty-na-prodazhu.pro

биржа аккаунтов https://rynok-akkauntov.top/

маркетплейс аккаунтов https://kupit-akkaunt.xyz

покупка аккаунтов https://akkaunt-magazin.online

маркетплейс аккаунтов соцсетей akkaunty-market.live

магазин аккаунтов магазины аккаунтов

магазин аккаунтов https://akkaunty-optom.live/

продать аккаунт https://online-akkaunty-magazin.xyz/

продажа аккаунтов https://akkaunty-dlya-prodazhi.pro/

магазин аккаунтов kupit-akkaunt.online

facebook ad account buy https://buy-adsaccounts.work

buy ad account facebook facebook ad account buy

cheap facebook account buy facebook profiles

buy facebook accounts cheap buy facebook accounts cheap

buy facebook old accounts buy facebook ad account

buy a facebook account https://buy-ads-account.work/

buy facebook account for ads https://ad-account-for-sale.top

buy fb ad account https://buy-ad-account.click/

Hello there, I found your blog via Google while searching for a related topic, your website came up, it looks good. I have bookmarked it in my google bookmarks.

buy aged facebook ads account buy facebook accounts

buy google ads account https://buy-ads-account.top

buy account google ads google ads accounts

buy facebook account https://buy-accounts.click

buy google adwords account https://ads-account-for-sale.top

buy google ads account https://ads-account-buy.work

buy aged google ads account https://buy-ads-invoice-account.top

google ads accounts for sale buy google adwords accounts

buy old google ads account https://buy-ads-agency-account.top

buy google adwords accounts https://sell-ads-account.click

google ads agency account buy adwords account for sale

buy facebook business manager buy-business-manager.org

google ads reseller https://buy-verified-ads-account.work

facebook business manager account buy https://buy-bm-account.org/

buy facebook bm account https://buy-business-manager-acc.org

facebook bm buy https://buy-verified-business-manager-account.org/

buy verified facebook https://buy-verified-business-manager.org/

buy facebook bm https://business-manager-for-sale.org/

buy business manager facebook https://buy-business-manager-verified.org

facebook business account for sale buy verified business manager

facebook business manager buy verified-business-manager-for-sale.org

buy facebook verified business manager https://buy-business-manager-accounts.org

tiktok agency account for sale tiktok agency account for sale

buy tiktok ads https://tiktok-ads-account-buy.org

Super-Duper blog! I am loving it!! Will come back again. I am bookmarking your feeds also

buy tiktok ads tiktok ads account for sale

buy tiktok business account https://tiktok-agency-account-for-sale.org

tiktok ads account buy https://buy-tiktok-ad-account.org

buy tiktok ads https://buy-tiktok-ads-accounts.org

цена натяжного потолка за квадратный метр http://potolkilipetsk.ru/ .

купить натяжные потолки цены купить натяжные потолки цены .

buy tiktok ads accounts https://buy-tiktok-business-account.org

tiktok ads account buy https://buy-tiktok-ads.org

buy tiktok ads account https://tiktok-ads-agency-account.org

монтаж натяжных потолков http://www.potolkilipetsk.ru .

натяжной потолок со светильниками натяжной потолок со светильниками .

Appreciating the persistence you put into your blog and detailed information you offer. It’s great to come across a blog every once in a while that isn’t the same out of date rehashed information. Wonderful read! I’ve saved your site and I’m adding your RSS feeds to my Google account.

Este site é realmente fantástico. Sempre que acesso eu encontro coisas diferentes Você também pode acessar o nosso site e descobrir detalhes! informaçõesexclusivas. Venha descobrir mais agora! 🙂

Great – I should certainly pronounce, impressed with your web site. I had no trouble navigating through all the tabs and related information ended up being truly easy to do to access. I recently found what I hoped for before you know it at all. Reasonably unusual. Is likely to appreciate it for those who add forums or something, web site theme . a tones way for your client to communicate. Nice task.

Greetings! Very serviceable par‘nesis within this article! It’s the scarcely changes which will obtain the largest changes. Thanks a quantity quest of sharing!